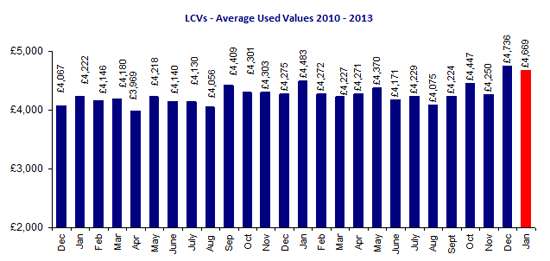

The latest BCA auction figures show that van prices remained firm in January, with the LCV average of £4,669 the second-highest on record since 2005.

BCA’s latest Pulse data shows average LCV values remained on a high in January, with fleet & lease values increasing and dealer part-exchange falling slightly from the exceptional prices seen in December, when lack of stock, a shorter trading period and changing mix contributed to the values achieved.

The average January figure of £4,669 for LCVs was the second highest on record for any month since Pulse began reporting in 2005. Both average age and mileage rose over the month to 56.6 months and 80,700 miles respectively. There was strong demand from professional buyers across the widest range of commercial vehicles and sold volumes rose significantly compared to December.

As the numbers below show, buyers are now paying more for an older van with higher mileage than they were this time last year, providing a graphic demonstration of supply and demand (and inflation):

| All vans | Avg Age | Avg Mileage | Avg Value | Sale vs CAP |

| Jan 2012 | 55.37 | 75,814 | £4,483 | 100.02% |

| Jan 2013 | 56.64 | 80,736 | £4,669 | 102.24% |

*Data courtesy of BCA

Duncan Ward BCA’s General Manager – Commercial Vehicles commented commented:

“Although the headline value declined compared to December, January essentially delivered more of the same – a shortage of stock allied to decent levels of demand that generated exceptionally strong prices in the used van market.”

“With stock remaining thin on the ground, buyer demand is focused on the best quality commercial vehicles and this is driving values up, particularly for corporate sellers where average values reached a new highpoint in January. Sale conversion rates also rose in January as buyers competed for stock and BCA saw lots of activity in the online arena with nearly a quarter of all vehicles being purchased by internet bidders.”

He added “The rise in average prices at the ‘value-for-money’ end of the market continues unabated and dealer part-exchange values have stepped up significantly over the past two months. This is likely to be a side-effect of the tough economic climate. With continuing redundancies across a range of business sectors from retail to manufacturing, many people will be tempted strike out on their own and one of the first things they will buy with their redundancy money is a van.”

I’m not sure when the pressure on used van supply will end — used van purchases are rarely discretionary and are usually driven by business need, so van operators are going to have to continue paying more in order to acquire second-hand vans.