Used van prices remain firmly supported by strong demand last month, according to the latest figures from auctioneers BCA.

The average value achieved of £5,151 was just £7 below September’s all-time record of £5,158, and was nearly 16% up on the average value achieved in October 2012. Sale prices remained well above CAP prices, as this table shows:

| All vans | Avg Age (mnths) | Avg Mileage | Avg Value | Sale vs CAP |

| Oct 2012 | 58.42 | 79,452 | £4,447 | 101.87% |

| Oct 2013 | 59.28 | 80,725 | £5,151 | 103.90% |

Data courtesy of BCA (www.british-car-auctions.co.uk)

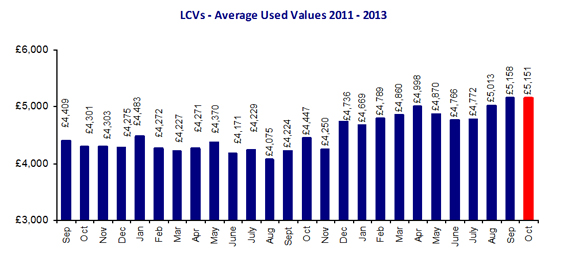

This graph shows how strongly prices have risen over the last two years, thanks to an underlying shortage of supply caused by the slump in van sales in 2009, from which the UK’s van market has still not recovered, as I discussed last week:

Average used LCV prices at auction for the two years to October 2013, courtesy of BCA.

Vans and 4x4s going under the hammer at a BCA LCV auction.

Duncan Ward, BCA’s General Manager, says that the problem is a lack of used supply from big corporate fleets, which typically feed the top end of the used market:

“This stock shortage is a long term issue that results from collapse of the new van market in 2009. Four years on, the big corporate fleets that provide the bulk of the ‘first time to market’ used vans simply do not have the same volumes to sell.

Professional buyers who typically buy corporate vans at auction are finding they have to bid harder and higher to secure the same stock and this trend is set to continue. And in terms of seasonal movements, the onset of bad weather usually marks an increase in demand for four wheel drive vehicles and we can expect to see average prices for 4×4 pick-ups rise in the coming weeks.”

“While new van sales are recovering, they are nowhere near the levels seen in pre-recessionary times. The used sector shortage is set to continue until new van volumes pick up significantly and the economy improves enough to generate a bigger churn of vehicles in the marketplace.”

As I discussed last week, sales of medium vans (Transit-sized vans), which accounts for around 60% of UK van sales, remains nearly 20% lower than it was in 2003 and is down by around 30% on pre-recessions peak levels. Clearly there is a lot of ground to make up still — and so business is likely to remain brisk for those in the used van trade.

One side-effect of this is that van hire companies, which traditionally buy new and keep their vans for a short time, should continue to achieve strong residual values when they sell their vehicles, which will, in turn, help keep rental rates down, adding to the attraction of renting, rather than buying, for businesses whose need for vans varies through the year. In effect, van rental companies are shouldering the burden (quite profitably) of financing and supplying flexible capacity to van operators, who are happy to employ a ‘pay as you go’ model and reduce their finance commitments.

In my view, this situation could continue for some time and may even become permanent, to some extent, as SMEs find it harder to get competitive financing than they used to, while van hire companies are able to enjoy economies of scale and provide ‘all-in’ rates for flexible hire of nearly new vans that make owning or leasing seem unattractive.

Pingback: Used Van Prices Expected To Rise Further In 2014 - Van News: The VanRental.co.uk Blog

Pingback: November Sales Leave Used Van Prices Up 20.2% In 12 Months - Van News: The VanRental.co.uk Blog