Commercial vehicle buyers are purchasing more car-derived vans (CDVs) and small panel vans, due to a chronic lack of larger panel vans (over 3.5t) in the market, according to the latest market analysis from vehicle remarketing firm Manheim.

Commercial vehicle buyers are purchasing more car-derived vans (CDVs) and small panel vans, due to a chronic lack of larger panel vans (over 3.5t) in the market, according to the latest market analysis from vehicle remarketing firm Manheim.

According to Manheim’s sales figures, the volume of smaller vans entering the used market has risen by around 8% over the last year, while the number of larger panel vans (>3.0t) reaching Manheim’s salerooms has fallen by 14%.

Manheim’s figures show that the that price of a larger panel van (>3.0t) — a traditional fleet workhorse — peaked at £5,297 in May, prompted by continued high demand and a modest fall in average age and mileage, which fell from 62 months to 61 months and 86,062 to 84,510 miles respectively.

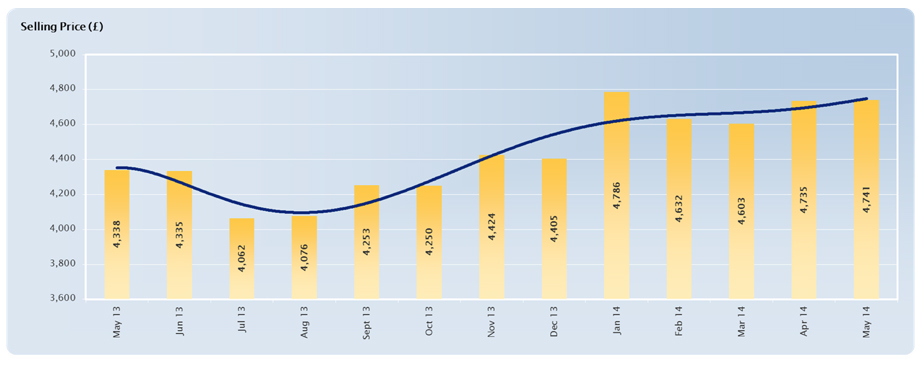

Across the market as a whole, the average value of a used van has risen by 9.2% to £4,741 over the last year, despite an increase in the total volumes of vans hitting the used market, as Matthew Davock, head of LCV at Manheim, explains:

“2014 has seen a continuation of the record levels of demand in the used van market. We have seen two months of significant year on year increases in van de-fleets; these vans have been snapped up by eager buyers looking to secure price range quality stock.

“Interestingly, the mix of vans has changed over the past twelve months, with many more car-derived and small panels vans coming up for sale. Conversely, the lower volumes of larger panel vans we’re seeing is, we believe, driving a shift in buyer behaviour toward smaller vehicles.”