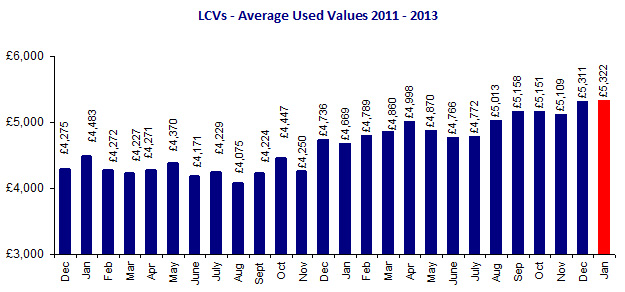

Used LCV values hit a new record in January 2014, but price growth appears to be slowing.

The relentless march upwards of used van values continued in January, as I predicted.

According to the latest figures from vehicle auctioneers BCA, average values for all light commercial vehicles increased marginally in January 2014 to £5,322 – a rise of £11 compared to December 2013.

January’s average value was the highest since BCA began reporting monthly sales in 2005, and was the sixth month in a row that average values across all light commercial vehicles exceeded £5,000.

On a year-on-year basis, January’s used LCV prices were 13.9% — or £653 — higher than in January 2013, despite the average age of vans being sold having risen by 1 month over the same period.

The average sale price relative to the CAP [book] price remained unchanged on one year ago, with vans selling for an average of 102% of their book price:

| All vans | Avg Age (mnths) | Avg Mileage | Avg Value | Sale vs CAP |

| Jan 2013 | 56.64 | 80,736 | £4,669 | 102.24% |

| Jan 2014 | 57.90 | 79,654 | £5,322 | 102.24% |

Data courtesyt of BCA (www.british-car-auctions.co.uk)

Duncan Ward, BCA’s General Manager – Commercial Vehicles, confirmed that January had delivered as expected:

“January essentially delivered more of what we saw throughout the previous 12 months – a shortage of stock allied to decent levels of demand that generated exceptionally strong prices in the used van market.”

“With stock remaining thin on the ground, buyer demand is focused on the best quality commercial vehicles and this is driving values up. BCA saw lots of activity in the online arena with around a quarter of all vehicles being purchased by internet bidders and BCA’s Video Appraisals are helping to create additional confidence for remote buyers.”

Mr Ward also confirmed that used van prices were rising at the bottom end of the market, in a sign that the rising tide of demand is lifting all vans, regardless of quality or age:

“The rise in average prices at the ‘value-for-money’ end of the market also continues and dealer part-exchange values reached a new record level. In fact, demand has been right across the board, from older higher mileage vans through to younger ex-fleet and lease vehicles.”

Although average values fell in both the ex-fleet/lease and nearly-new categories, BCA says that this was largely due to changing model mix in the fleet market and the volatility created by very limited volumes in the nearly-new market. Overall, demand remains strong, although my interpretation of the graph below, showing all sales, is that the growth in demand may have reached a peak and be beginning to slow, as you’d expect in a market where new van registrations are rising strongly:

BCA LCV prices 2011-2013 (Jan 2014)