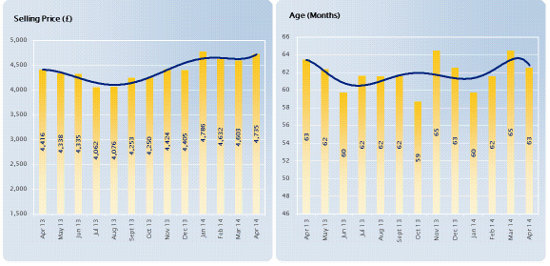

Used van prices at auction orse in April, according to Manheim, whose latest market analysis shows that average LCV values bounced back to near-record levels of £4,735 during last month. This increase of £132 during the month came in the context of a fall in average mileage from 80,302 to 80,191 and a fall in the average age from 65 months to 63 months.

On a sector-specific level, 42% of all vans sold in April coming from car-derived van (CDV) sector. The average CDV in April was four months older (61 months) and mileage had increased from 69,982 to 70,128, which had an impact on the average selling price, which fell from £3,667 to £3,499 during the month.

However, within the small panel van sector, the second highest volume sector during April, average age fell from 74 months to 68 months and average mileage increased from 78,832 to 87,925 over the month. This increase in younger vehicles at auction had a positive impact on values for the segment, as they rose from £4,131 to £4,444.

Manheim’s head of LCV, Matthew Davock, explains:

“Despite the slight decrease in buyers at auction during April, many of the people that I have spoken to are reporting that the first three months of 2014 have been the strongest that they have seen in five years, with many of them keen to stock up and replace sold units. When comparing the year-on-year values, 2014 vehicle prices have remained very strong and we continue to see a great appetite in the market for older age, older mileage stock.”

James Davis, head of commercial vehicles at Manheim, concluded:

“As I predicted last month, it would appear that the watershed moment in the wholesale market has occurred and the number of older used vans entering the market will now begin to decline gradually. Daily rental companies are already predicting an increase in stock levels over the coming months, as lead times on new stock delayed the replacement in quarter two. This increase in good quality, younger vehicles into the market will have a positive impact on the average selling prices as we enter the summer.”

However, the two graphs below, from Manheim, suggest that prices have risen far more than average age, which is actually the same as it was a year ago — i.e. buyers are paying more for less, in terms of £/age. In my view, greater volumes of nearly-new vans, combined with rising new van sales, could still put pressure on this premium, which has built up over several years:

Used van ages and prices for the twelve months to April 2014 – courtesy of Manheim

Have I called the top of the used van market too soon? Probably, but I remain cautious and will be interested to see if trends have changed by the autumn.