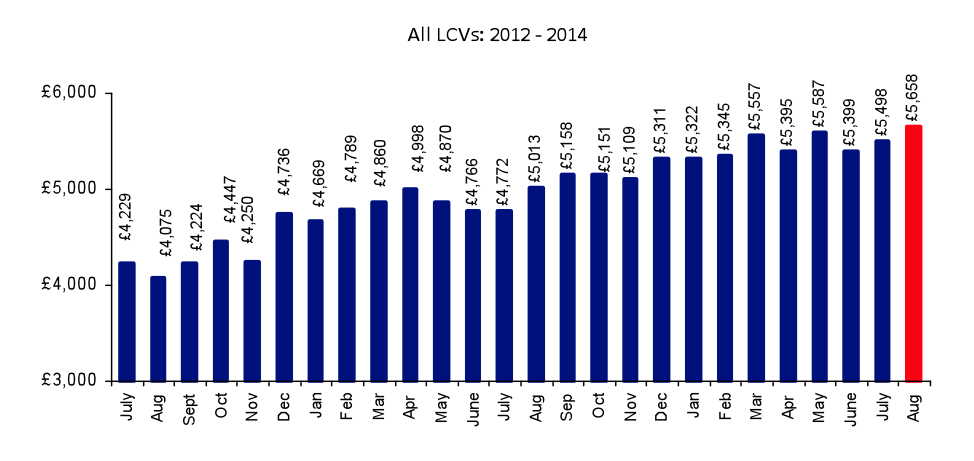

Average used van values hit an all-time high of £5,658 in August, according to the latest sales data from British Car Auctions (BCA). According to the firm, demand from professional buyers remained strong last month and shortages of good retail quality vans continued.

The average van at BCA sold for £5,658 in August, an increase of £160 (2.9%) compared to July and the highest monthly average figure on record. Fleet & lease and nearly-new values rose, month-on-month, while part-exchange values fell back. Year-on-year values remain well ahead by £645 (12.8%), with both age and mileage falling and performance against CAP improving slightly.

Used van values July 2012 – August 2014 (courtesy of BCA)

I obviously have some egg on my face, having been calling for the peak of the used van market for a little while now, but I would like to point out one quirk in the figures, which suggests to me that the outright increase suggested by the graph above may not be the only interpretation of the facts.

[Update 08/09/14: Figures from the Finance & Leasing Association have just crossed my desk, showing that used car purchases by businesses fell by 50% in July, compared to the same period last year, while new car purchases (on finance) rose by 29%. If similar trends are being seen in the new and used van sectors, then we could soon see further downwards pressure on used van prices.]

Mix change?

Although the overall average price was the highest on record in August, the average value of fleet and lease sector vans was lower than in the peak months of February and March. Similarly, the average value of part-exchange vans has fallen continuously since May, while the average value of nearly-new vans was also lower than the peak values of February, March and several other months over the last two years.

In other words, the overall average used value is at an all-time high, but none of the average sector values are.

To me, this suggests the mix of vehicles being auctioned may have changed — BCA don’t specify the relative volumes sold in the fleet and lease, part-ex and nearly-new sectors, but my understanding is that nearly-new volumes are pretty low, while the largest volume comes from the fleet and lease sector.

If this is true, then an increase in the number of ex-fleet and ex-lease vans coming through the salerooms could have boosted the overall average price to a new record high, even if the average price of each van sold did not rise. This is also supported by the continuing rise in new van registrations, which rose by 22% in August, compared to August 2013.

This is only my opinion, of course. If you know better, please leave a comment below or let me know on Twitter (@vanrentaluk) or Facebook facebook.com/vanrentaluk).