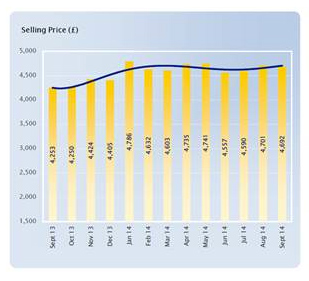

Manheim selling prices, Spetember 2013 – September 2014 (courtesy of Manheim)

I may have spoken too soon: remarketing specialist Manheim has reported that the average value of vans sold during September 2014 was £4,692, which is £438 or 10.3% higher in comparison with the previous year, despite an increase of one month in average age and 263 miles in average mileage.

On the face of it, this suggests buyers are returning to their old habits, and are willing — or forced — to pay more, for older, higher mileage vans.

However, as always, the devil is in the detail.

First of all, it’s interesting to note that BCA’s average used van value during September was £5,560, whereas Manheim’s was just £4,692. I think it’s reasonable to assume that this difference is caused by some combination of a different age mix or a different model mix — there’s no way to such closely-matched competitors could sell the same mix of vehicles at such different prices.

Secondly, it’s worth noting that prices are down from the £4,786 peak reached in June this year, so it’s a rise relative to last year, but still lower than buyers were paying earlier this year.

Despite this, it’s clear that the used van market remains in rude health. The strong values in the used van market are also reflected in the percentage of original new price, Manheim’s unique comparison between the used and new price of vans. This measure shows that vans are currently achieving 28% of their original price, compared to 26% a year ago.

Looking at the data in more detail, Manheim’s analysis for September 2014 shows that the average selling price of small panel vans grew by 14.8% to £4,733 over the past year. Large panel vans over 3 tonnes saw a rise from £4,815 to £5,335 (10.8%) and car derived vans increased by £132 to £3,363 over the same period.

Matthew Davock, head of light commercial vehicles at Manheim, believes that van prices will continue to increase as winter approaches:

“The market performance has remained very healthy in the recent weeks, but stock shortages have remained a concern, which will maintain demand and prices. Vendors are typically enjoying conversion rates of 80% plus and when stock profile matches buyer requirements 100% sales are the norm, even with damaged product being snapped up in the absence of cleaner vans. We don’t see any significant changes in volume trends, which will only contribute towards a continued strong marketplace for the remainder of the year.”

A bull market will often run for longer than anyone expects, and so it is here: the shortage of good quality used stock is the consequence of the fall in new van registrations after the financial crisis.

However, I continue to believe that used van prices have now peaked: the continued rise in new van registrations must surely be weighing against used demand — and when increased volumes of new vans from 2012 onwards start to hit the used market, the pendulum may start to swing the other way.