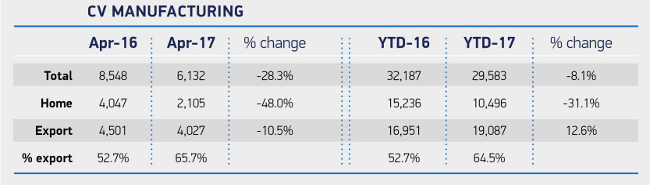

Commercial vehicle manufacturing output from UK factories fell by 28.3% to 6,132 units in April, down from 8,548 during the same month last year.

The latest figures from the SMMT show a sharp decline in output for April. One argument put forward by the motor industry trade body is that the timing of Easter (late April) reduced the number of working days in April, depressing output.

Easter fell in March last year, so there’s obviously some truth in this argument. However, I don’t see how an extra two days off can account for a fall in production of nearly one third. Strangely enough, manufacturing output also fell in March 2017, even though the same period last year contained two bank holidays that moved into April this year.

It seems clear to me that underlying demand is also falling. That’s not necessarily a problem after a long period of strong demand, as Mike Hawes, SMMT chief executive, explains:

“With fewer working days in April and following two years of exceptionally strong demand, it’s not surprising to see a decline in CV output, especially when you consider the effect of fleet buying cycles on manufacturing timing. However, as the proportion built for export reaches levels not seen since the start of this decade, it highlights the importance of maintaining good links with our biggest trading partner, Europe. Securing a strong trading relationship will be vital to the continued success of UK CV manufacturing.”

Looking at the figures in more detail, it’s clear that it’s weak demand in the UK which is really eating into the output of our factories:

Source: SMMT

UK demand almost halved in April and has fallen by nearly a third so far this year. That’s a hefty decline. Although some of this may be due to shifting fleet replacement cycles (some of which can account for hundreds of vans in a single order), I suspect underlying demand may have weakened somewhat.

It will be interesting to see which way orders go for the remainder of the year. If bank holidays and fleet purchasing cycles are to blame for the slump in demand, I’d expect some normalisation during the remaining seven months of the year.

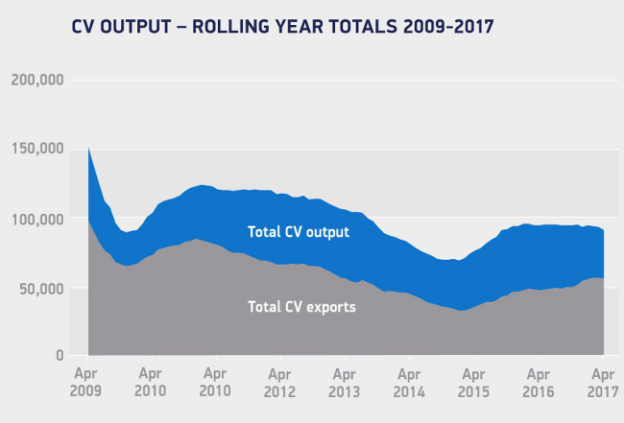

After all, it’s worth putting these figures in perspective. Export demand is up by 12.6% so far this year and overall production has only fallen by 8%. Looked at on a bigger scale — from April 2009 up to April 2017 — the picture still looks fairly benign:

Source: SMMT