The new Citroen Relay will be unveiled at the 2014 CV Show.

Citroën has revealed details of its new Relay van ahead of its official CV Show debut next week (29 April – 1 May).

The new Relay, which will also be sold as the Peugeot Boxer, will be available in 3.0, 3.3, 3.5 & 4.005 tonne gvw formats, as well as in chassis cab format. Citroën’s Relay Specialist pre-built conversion range will be continued, enabling buyers to order Relay tippers, dropsides and Lutons direct from Citroën dealers.

Peugeot will offer a similar range, along with its ‘back-to-back’ model — two cabs without chassis delivered as pairs for specialist conversions requiring a different chassis. These are typically used for removals vans and large motorhomes, which use larger, lower chassis platforms than conventional conversions.

As is increasingly the trend with large vans, the Relay will be powered by a single engine, a 2.2HDi, which will be available in three power outputs, 110, 130 and 150PS. Peugeot is opting for a slightly different approach, and while the same 2.2HDi engine, in 110, 130 and 150PS formats will power the bulk of Boxer vans, it is retaining a 3.0-litre HDi 180 model for buyers who are looking for a good long-distance, heavyweight performer.

Both firms will market the new panel van models in four lengths, ranging from L1 (8.0 m3 and 2.67m load length) to L4 (4.07m load length and up to 17m3 capacity). Three roof heights, H1, H2 and H3 will be available, although as with payload options, not all combinations will be possible.

Inside the cab of the new Peugeot Boxer, whose sister van, the Citroen Relay, will be unveiled at the CV Show 2014.

The new vans will be front-wheel drive only, but will be available with Intelligent Traction Control/Grip Control, the PSA electronic limited slip differential system that helps provide additional traction in slippery conditions. Electronic Stability Control will be standard on all models, while a Lane Departure Warning System and Hill Descent Control will be optional extras.

Finally, both vans will boast extended service intervals of up to 30,000 miles/two years, although in my opinion, only high mileage users should even consider this: my view is that extended service intervals are one of the reasons that modern diesels suffer so many expensive problems once they get out of warranty.

I also believe that from a safety perspective, all vehicles should have an annual service: honestly, what kind of business can’t schedule half a day downtime for each of its vans, once a year, in the name of safety, reliability and durability (not to mention resale value)?

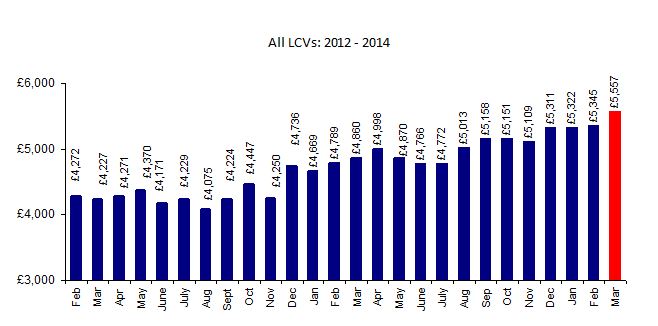

The last three years have seen the average age of used vans at auction rise steadily, as fleet operators extended their replacement cycles in an effort to defer capital expenditure and new debt commitments.

The last three years have seen the average age of used vans at auction rise steadily, as fleet operators extended their replacement cycles in an effort to defer capital expenditure and new debt commitments.