BCA van auction in June (source: BCA)

Used van prices remain close to record highs, according to the latest figures from auction group BCA.

The average price of LCVs sold by BCA during June was £7,463, the fourth highest on record at the group. Average used van prices are now more than £1,000 — or 15% — higher than one year ago.

A used van probably still makes sense for van operators such as tradesmen, who need their van day in day out, but may not cover much mileage. But for van users who only need their van some of the time, I think these figures from BCA suggest a strong case for renting rather than owning.

Let’s look at some example costs to see whether renting might be cheaper.

Renting a van vs buying used

If you’re buying a van from a used van dealer, you’ll be paying the auction price plus extra to cover the dealer’s costs and profit margin. But even if you’re a savvy buyer who knows vans and buys directly from auction. our average priced van will still cost around £8,000 by the time you’ve paid your buyers fees.

On top of that, you’ll need to tax and insure the van. You might need to have it delivered, too. And it might need servicing or minor repairs.

I think it’s fair to assume that the all-in cost of getting our average used van on the road will be around £8,500. That’s quite a lot of money. How many weeks’ rental might this pay for?

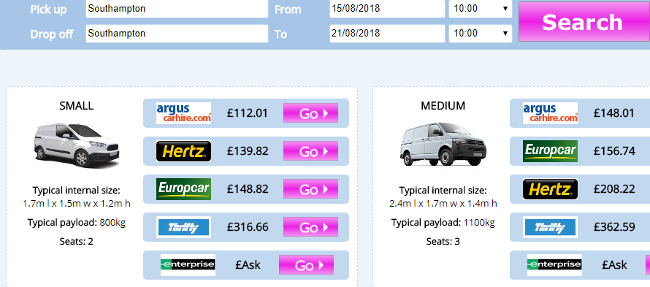

I’ve got some sample results from the vanrental.co.uk price comparison engine. A week’s hire of a medium-sized van (e.g. Ford Transit Custom) seems to be available for around £160. For a long wheelbase van you might have to pay a bit more:

An example set of results from our independent price comparison system.

Lets assume the average rate per week for a hire van is about £175. Remember that long-term hire rates are available if you need a van for a month or more, so it may be possible to improve on this.

At £175, your £8,500 budget would allow you to rent a van for about 48 weeks, or around 11 months. If you only need a van for two weeks each month, that’s almost two years’ usage.

And if you only need a van for a few days each month — perhaps you go to trade shows or markets — then hiring a van will mean that your average used van buying budget would stretch for years.

During this time, you’d get to keep most of the cash, on paying out on a ‘pay as you go’ basis. You should also get to drive a nearly-new van all the time, rather than an ageing secondhand model.

Another overlooked benefit of renting is that you aren’t responsible for any of the van’s running costs, except fuel. You won’t have to pay for servicing, repairs (except damage), replacement tyres, MOT tests or road tax.

Most companies include insurance too, so that’s another cost off your books. Over several years, these savings can be considerable.

And while it’s true that renting often carries extra costs over and above the headline rental fee, many of these costs are optional and can be reduced. For example, instead of buying extra insurance from you hire company, you can buy an annual excess protection policy from a specialist insurer. If you’re hiring a van regularly, this is likely to be much cheaper.

If you’re in the market for a used van that will only be used for two weeks of each month or less, I think there’s a strong case for renting instead.

I urge you to run the numbers yourself before making a final decision. By renting, you could save yourself money and avoid the headaches of used vehicle ownership! Why not give it a try?

Manheim says that the group offered 20% more vans for sale during March 2017 than in March 2016, and 6% more than in February 2017.

Manheim says that the group offered 20% more vans for sale during March 2017 than in March 2016, and 6% more than in February 2017.

The average sale price of used vans at auction fell by 0.7% to £5,544 in July, according to BCA auctions.

The average sale price of used vans at auction fell by 0.7% to £5,544 in July, according to BCA auctions.