My Car Check Trade offers instant valuations and Cat D checks for traders. All that’s required is the licence plate.

“There must be practically zero profit on many retail [used van] sales.”

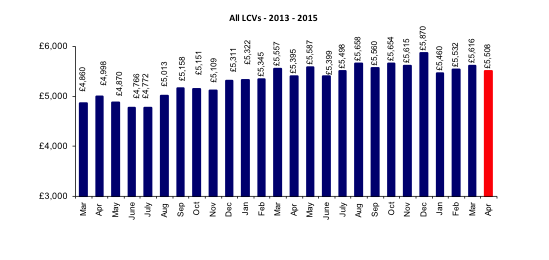

Those are the words of David Hill, who is My Car Check Trade’s LCV expert. Mr Hill’s latest report on the state of the used van market arrived on my desk this morning and makes interesting reading.

He comments that the prices currently being paid at auction must mean profit margins for used van dealers are extremely limited — noting that “dealers are now telling us they’ve got all the stock they need, so they’ve got very short shopping lists”.

I’ll take a look at some detail in a moment, but it’s clear the overriding message is that most parts of the used van market are well supplied. The pressure we’ve seen recently on auction prices is thus very likely to continue. This is a message I’ve been hammering home for some time now.

However, as with any market, supply and demand does vary according to van type. There are some niches of strong demand and others where prices are slipping.

In demand

According to Mr Hill, one area where good quality retail stock is short is the large panel van sector. Generally speaking that means long wheelbase panel vans with a gross weight 3.5t:

As a result, any long wheelbase van in good condition with sensible miles will be highly desirable.

There’s also healthy demand for other larger models. Mr Hill singles out Renault Master-based low floor lutons, which he says are “currently making all the money”. Elsewhere, Ford Fiesta Van and Vauxhall Corsavan models are solid performers, wiping the floor with the unloved Peugeot 206 Van.

Electric vans are starting to trickle onto the used market, and here vanrental.co.uk’s favourite model, the Nissan E-NV200, has proved to be a top performer, as it includes batteries. With many other models, a seperate battery leasing agreement with the manufacturer is required. That might be acceptable in the new market, but was always likely to be unpopular in the used market.

Finally, the volume of used Volkswagen Caddy vans entering the market has eased, meaning prices have firmed up somewhat. However, buyers should “think carefully” before buying low horsepower models, says Mr Hill.

Not so hot

The Ford Transit Custom is, in my view, one of the very best vans on the market today. However, now that it’s starting to appear in “small pockets of volume”, used prices of entry-level models are being weakened by Ford’s competitive pricing for new models, according to Mr Hill.

In the current market, used buyers of Transit Custom are focusing on Trend and Limited models, says Mr Hill, with many requiring air-conditioning in order to consider a purchase.

Elsewhere, the Fiat Doblo is in ample supply and prices are suffering due to high volumes of similar models. Be very choosy. While Renault Kangoo Maxi vans are in demand, the more common standard Kangoo is plentiful so don’t overpay.

Tipper models, which have often done duty in the construction sector, must not be battered into submission. Tidy bodywork and interior are required for a strong sale. Crew cabs are useful.

What’s next?

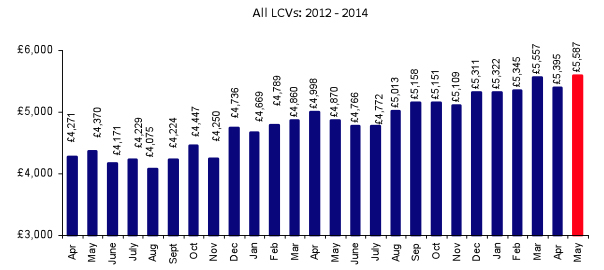

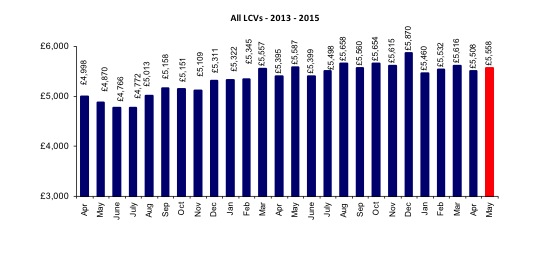

In my view, the situation described by Mr Hill will require something of a shake-out in the auction and part-exchange markets. This is likely to result in further price weakness at van auctions, something we’ve started to see over the last few months and which I believe will continue.

For businesses operating vans who are tempted to buy used but would like to see prices come down a little first, now could be a good time to rent. Many companies now offer rolling 28-day contracts. Some even offer zero notice period long-term hire, where you can simply keep a van for as long as you want and then return it with no notice required.

Alternatively, if you’re confident about your firm’s order book and believe you can keep a van busy, then buying new could be a smart move. Manufacturers are hell-bent on driving up sales volumes and are offering attractive prices and financing packages on new vans. Note David Hill’s comments above regarding Ford and Transit Custom prices.

Used van prices at auction were largely unchanged in May, according to the latest figures from British Car Auctions (BCA).

Used van prices at auction were largely unchanged in May, according to the latest figures from British Car Auctions (BCA).

According to research carried out by Mercedes-Benz Vans, 58% of small businesses (SMEs) loan applications are rejected by high street banks.

According to research carried out by Mercedes-Benz Vans, 58% of small businesses (SMEs) loan applications are rejected by high street banks.

Despite

Despite